Why should you use a government insurance program like Dairy Revenue Protection?

May 21st, 2019

Why should you use a government insurance program like Dairy Revenue Protection?

When it comes to insurance, there are a lot of questions. Is it worth it? What’s best for me? How much will it cost?

Dairy Revenue Protection (DRP) is the new government Dairy Insurance program that started in October of 2018. Following the government shutdown, we’re really only able to see some of the affects starting up now in quarter two of 2019, but there’s still lots of information out there about it. DRP is not the MPP or LGM we’ve seen in the past. Though also designed to insure against unexpected declines in milk revenue, DRP is quarterly, has positive outlooks, and is completely compatible with other programs like Dairy Margin Coverage or our ROF program.

First, DRP is much more flexible than programs we’ve seen in the past. With the introduction of the protection factor variable and the ability to choose protections in a countless variety of ways while also being able to purchase more than one endorsement per quarter, there really is some plan that works for everyone’s situation within the 5 decisions a producer has to make. These choices include:

- What quarter to insure (up to 5 nearby quarters)

- How to value Milk covered (Class or Component based pricing)

- Quantity of Production to insure

- What protection factor in insure

- What coverage level to choose (70%-95%)

With this variety comes the difficulty of knowing what’s right for your dairy. On top of all these options, many of the insurance agents who are providing the insurance lack knowledge or effective tools to provide quality support for producers, being that the program is new and untested.

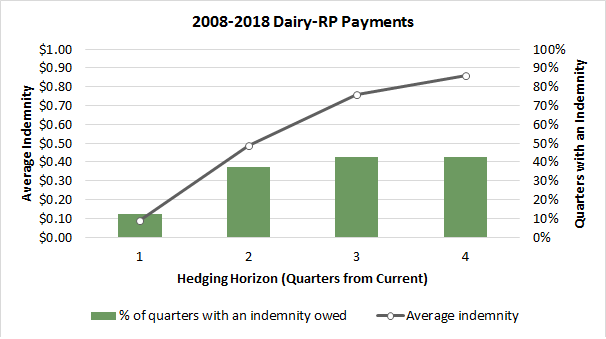

The tough part in DRP is deciding what’s best for a producer. There are tools available to investigate and test outcomes with your dairy’s attributes for optimal results. Ag Hedge Desk provides a robust and unique set of tools to best serve both producers and agents in using DRP, but producers will only be able to access them if their insurance provider is partnered with us. However, as risk management consultants and market makers on we’ve seen some themes in our tests and tools. In regards to a timeline, we’ve seen purchasing insurance for further horizons being more profitable, as working 3,4,5 quarters out has shown to be much more effective than only one or two quarters out.

Additionally, our analyses have shown higher protection factors as well as higher coverage levels to bring the most beneficial outcomes for dairies, though only as their able. The higher the coverage, the more effective it is, but also the higher the premium.

Finally, what’re the cash details? The price of the insurance is dependent on the decisions made by the producer and the volume that is being insured. After selecting these numbers, a premium will be owed to purchase the insurance. The premium doesn’t need to be paid until around a month after the END of the quarter for which they purchased insurance. A producer will be paid if the milk price settles lower than their guaranteed value and if the amount they’d be owed (the indemnity) will exceed their premium cost. If not, they would still have to pay the reduced premium, but they would have made more on their milk check since the price didn’t drop enough to pay out further.

Overall, we feel DRP is definitely worth it, but producers should research into what’s optimal for them.