Why should you hedge with Revenue Over Feed?

May 9th, 2019

Before subscribing to any program, why is always a great question to ask. How will it help me? Is it worth it? What does it cost? What is Hedging?

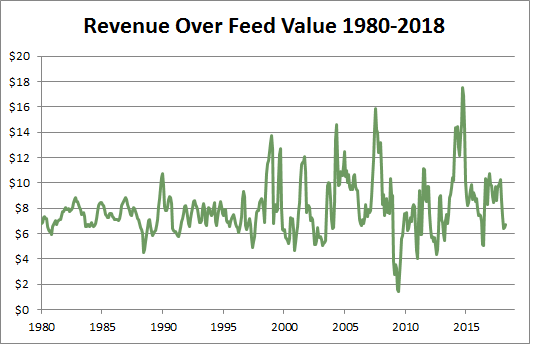

To start, the dairy market is more volatile than ever, with unpredictable and wavering prices. With more dairies closing year after year, doing nothing in regards to risk management isn’t an option for successful dairies. Weathering lows has become extremely difficult while the highs are less consistent. Below is a graph of the margin settlements of our Revenue Over Feed hedging program over the past 40 years. As you can see, the market has grown more volatile and unpredictable over time.

Without hedging, insurance is the only protection against these volatilities to weather the lows. However, there are options to make the tough times easier and financials more consistent.

One of those options is Ag Hedge Desk’s Revenue Over Feed. With such an unpredictable market these days, why not make the best of something you know to be manageable and consistent? That something is a dairy’s feed. A farmer knows how much feed they’ll need for their cattle, so we found a way to offset that cost using the market. Revenue Over Feed is a risk management program that combines a dairy’s profitability into a single number, which we named Revenue Over Feed. The graphic below visualizes the equation, showing each part of a dairy’s profit equation.

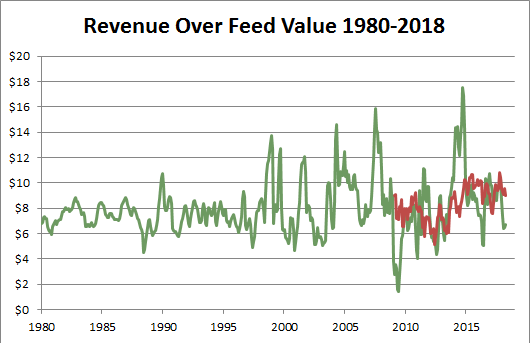

Using this program, a dairy can offset their feed costs by hedging corn and soymeal portions of feed components. Hedging helps negate loss and create consistency to an ever changing industry. Here’s an example of what a pricing graph would look like when hedging is used:

As shown, when hedging the feed costs, the value becomes much more stable, with a lot lower range of value than when there was no hedging involved.

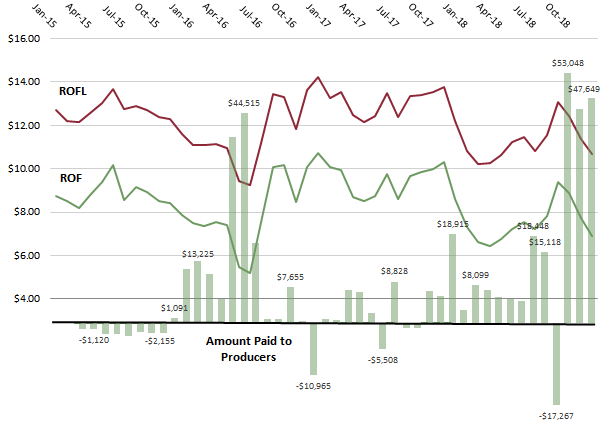

Another big concern is cost. Both our programs do not have an enrollment fee. A producer selects an option price, quantity, timeline and ceiling/floor for a trade in ROF to begin, and then lets that trade work itself through completion. Horizon Pricing requires a producer to only pick a quantity, a strategy, and a timeline. After selection, Ag Hedge Desk will dynamically manage and hedge this quantity on behalf of the producer. If the market settles outside of their margins, a producer may then be eligible to collect funds owed to protect against loss during that dip. For in depth examples of these occurrences, check out the ROF Case Studies we have posted on the site, but, the payouts have greatly benefit producers in recent years, as shown below

This graphic covers the last three years’ results, totalling to $422,692.00 paid to producers through the program. When the markets were low, Revenue Over Feed paid out to offset cost and protect dairies.

Another advantage these hedging programs provide is that they’re completely compatible with government programs. Combining hedging with dairy insurance programs like Dairy Revenue Protection (DRP) and Dairy Margin Coverage (DMC) provides some sound protection.

The benefits far outweigh the costs when it comes to hedging, so why wouldn’t a producer want to hedge?